HRSA audited covered entities across 40 states. The results were alarming: 62% had incorrect OPAIS records, 17% showed duplicate discount violations, and 17% had evidence of drug diversion. For healthcare providers already operating on razor-thin margins, a single audit finding can mean millions in repayments and months of operational disruption.

The root cause? Fragmented data, manual workflows, and limited visibility across contract pharmacy networks. As HRSA intensifies oversight and manufacturers impose additional restrictions, covered entities face a critical decision: continue managing 340B compliance manually and accept increasing risk, or adopt technology solutions that prevent errors before they trigger audits.

However, the 340B report makes it clear that continuous compliance software/solutions are essential for monitoring every eligible transaction, proactively flagging risks, and safeguarding program savings. This technology-enabled approach allows 340B analysts to identify and address errors before they become audit findings. But the fear or resistance to change remains a barrier to the adoption of technology (Source: MGMA AI Research Report), making the situation more difficult, causing financial and operational challenges. Let’s discuss these challenges in detail in this blog and how technology solutions can help.

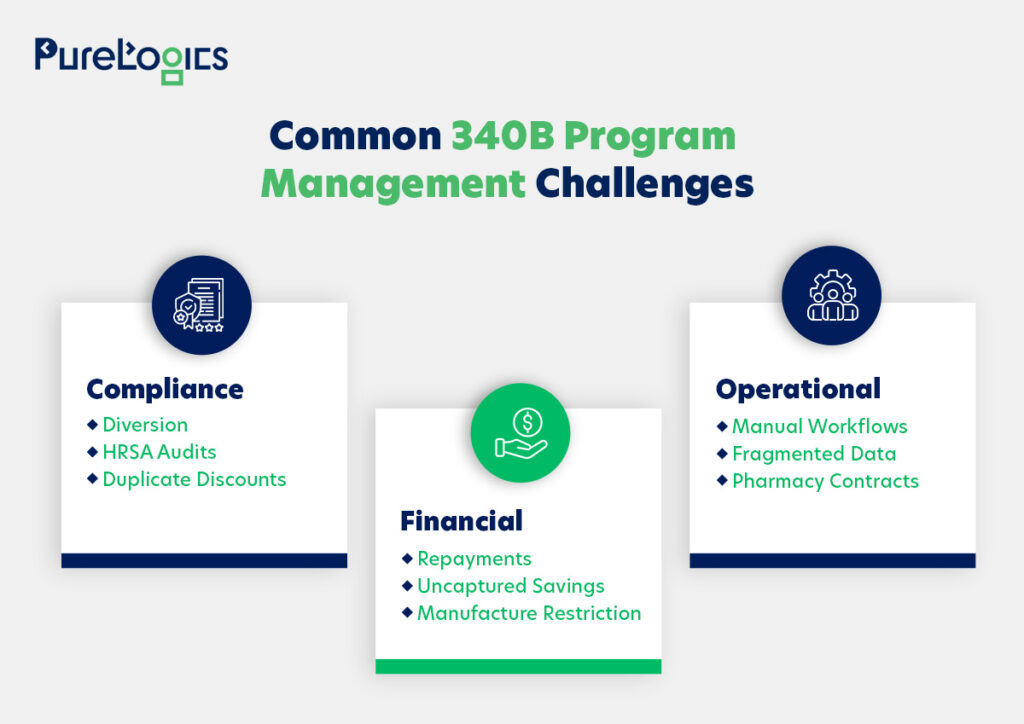

Main Challenges Covered Entities Face in Staying 340B Compliant

Compliance complexity, diversion risks, duplicate discounts, and fragmented data across multiple sites and contract pharmacies make program management difficult. We have categorized these issues into three critical dimensions:

- Financial challenges

- Compliance challenges

- Operational challenges

Effective 340B program management requires a clear understanding of these challenges; otherwise, HRSA audits may be triggered. As happened in the case of the six major drug makers Eli Lilly, AstraZeneca, Novartis, Novo Nordisk, Sanofi, and United Therapeutics, which HRSA flagged for overcharging 340B hospitals by limiting contract pharmacy discounts. In response, HRSA referred the cases to the HHS Office of Inspector General to assess potential civil monetary penalties and enforce compliance.

Are Your 340B Challenges Putting You at Risk?

Manual workflows, fragmented data, and complex contracts can increase audit risk.

Let’s discuss these compliance challenges in detail, starting with compliance risks such as diversion, HRSA audits, and duplicate discounts.

Compliance Challenges

The compliance challenges that the covered entities can face are given below:

Diversion

In the 340B Drug Pricing Program, diversion is the inappropriate distribution of discounted drugs to patients who do not fulfill the program eligibility criteria. Covered entities are authorized to purchase these medications at lower prices exclusively for qualifying patients, especially those receiving care in an outpatient setting.

However, dispensing 340B drugs to ineligible patients exposes healthcare providers to regulatory scrutiny and potential penalties from HRSA. That’s why it is essential to mitigate diversion so that the program benefits the patients who truly need it.

82% of diversion findings stem from contract pharmacy prescriptions written at ineligible sites

Source: HRSA Audit Findings

Here, software with automated eligibility verification and real-time contract pharmacy monitoring can help prevent diversion by flagging ineligible prescriptions before they are dispensed.

HRSA Audits

HRSA, in the last few years, has intensified audits of 340B covered entities to enhance the oversight of the program, focusing on the following:

- Eligibility verification

- Drug diversion mitigation

- Duplicate discount prevention

Additionally, inadequate documentation or weak record-keeping can increase the risk of compliance violations and potential program suspension.

62% of covered entities audited by HRSA had incorrect 340B OPAIS records.

Source: HRSA Audit Findings

Deploying audit-ready documentation systems and conducting regular internal compliance reviews can ensure your organization maintains continuous readiness rather than scrambling to meet HRSA notification requirements.

Duplicate Discount

The duplicate discount is prohibited under 42 U.S.C. 256b(a)(5)(A)(i) of the 340B drug pricing program. This statute prevents drug manufacturers from providing both a 340B discounted price and a Medicaid drug rebate for the same medication. To comply with this requirement, covered entities must track 340B drug purchases and claims. Moreover, failure to prevent duplicate discounts can cause compliance risks and potential financial liabilities.

91% of duplicate discount violations stem from incomplete Medicaid Exclusion Files.

Source: HRSA Audit Findings

However, software with features like automated Medicaid Exclusion File validation and real-time claim monitoring eliminates duplicate discounts by recognizing and preventing overlapping rebates before claims are submitted.

Evolving Manufacturer Restrictions

Drug manufacturers can impose restrictions that can limit the covered entity’s (CE) ability to access medications provided via contract pharmacies. These restrictions are not only financial but also a compliance challenge, as each manufacturer may have different rules that can change frequently.

Some key factors included are:

- Constant changes in ESP/Beacon policies make it difficult to stay compliant.

- Different rules for each manufacturer, requiring detailed attention for each drug supplier.

- Manual tracking, including up-to-date restrictions, is time-consuming and can cause errors.

These complexities can result in lost 340B savings and increased operational burden.

$8.4B in 340B savings are at risk due to manufacturer restrictions on contract pharmacies.

Source: 340B Health / HRSA‑FOIA

To address this, organizations need tracking and management systems that monitor manufacturer restrictions and optimize pharmacy networks. Moreover, automated solutions help covered entities adapt quickly, maintain compliance, and maximize 340B savings potential.

Financial Challenges

The primary financial challenges faced by covered entities are listed below, along with proposed solutions.

Repayments

When a covered entity fails an HRSA audit, it must repay manufacturers for any drugs improperly discounted under the 340B program. Such repayments underscore the importance of internal controls, accurate documentation, and adherence to program guidelines. Moreover, proactive compliance measures such as real-time tracking of 340B drugs and internal audits are essential to mitigate exposure.

18% of covered entity audits required repayment to manufacturers due to duplicate discount or diversion findings. (latest data available, FY 2024)

Source: Kodiak

Proactive compliance measures integrated into software, such as real-time 340B drug tracking, automated alerts for potential violations, and internal audits, can help minimize repayment risks before audit findings.

Uncaptured Savings

Covered entities face challenges in fully realizing the financial benefits of the 340B Drug Pricing Program, mainly due to drug shortages, frequent changes in manufacturer pricing formulas, and fluctuating patient volumes, which can create gaps between the discounted acquisition cost and actual utilization of 340B drugs, resulting in uncaptured savings. Furthermore, complexities in tracking patients’ eligibility, coordinating pharmacy operations, and aligning billing systems can further hinder the ability to maximize program benefits.

Here, the integrated technology platforms that unify patient eligibility data, inventory management, and billing systems across all sites can maximize savings by eliminating coordination delays and visibility gaps.

Operational Challenges

Many 340B participants face operational challenges, including fragmented data, manual workflows, and complex pharmacy contracts. These issues slow down operations and reduce visibility, making it harder for organizations to manage the 340B program effectively. Let us explain in detail the three factors that lead to operational challenges.

Manual Workflows

340B compliance is complex, and manual data entry, calculations, tracking patient eligibility, recording drug dispensing, and submitting claims can be complex. It also leads to audit findings, missed opportunities during HRSA inspections, and difficulty in scaling operations.

60% of HRSA audit findings are due to manual workflow errors in eligibility, dispensing, or reporting.

Source: HRSA Audit

Additionally, staff overload and burnout are common due to continuous rule changes and frequent backlogs. As compliance demands increase each year, TPAs and covered entities often find themselves in a “firefighting” mode, addressing urgent issues instead of focusing on strategic program management.

However, the automated workflow solutions can help eliminate manual errors, reduce staff burden, and enable scalable 340B program growth without proportional increases in compliance personnel.

Fragmented Data

With fragmented data, it becomes difficult for covered entities (CEs) to track patient eligibility, monitor drug inventory, and ensure proper dispensing across multiple sites and contract pharmacies. This leads to a lack of visibility, reducing potential 340B savings and increasing compliance risk during HRSA audits. However, technology solutions that consolidate data from EHRs, pharmacy systems, and billing platforms are crucial for maintaining oversight and for optimizing the 340B program. Here, technology solutions that consolidate data from EHRs, pharmacy systems, and billing platforms into unified dashboards offer visibility and eliminate compliance blind spots.

Pharmacy Contracts

One of the biggest challenges for covered entities (CEs) in the 340B program is establishing contract pharmacy relationships and coordinating data feeds, ensuring accurate tracking of drug dispensing, and handling split billing arrangements.

Additionally, it increases the risk of compliance errors, missed savings, and discrepancies being reported during HRSA audits.

Therefore, deploying solutions that automate billing and monitor compliance across all partners is essential for maintaining oversight, optimizing program benefits, and decreasing administrative burden. The automated contract pharmacy integration with real-time data feeds, split-billing management, and performance dashboards ensures compliance across all pharmacy partners while reducing administrative complexity.

Case Study In Focus: Southwestern Academic Medical Center 340B Program Compliance

An academic medical center based in the Southwest with three hospital locations, 1000+ total beds, 57 registered 340B child sites, 63 340B contract pharmacies, and $120M+ annual drug spend struggled with an underperforming 340B program.

Challenges They Faced

- They had limited visibility across systems, and the fragmented EMR data hindered decision-making.

- The inefficient pharmacy network restricted the organization’s ability to increase savings and optimize operations.

Solutions They Implemented

- They adopted a data-driven technology platform that consolidated information from multiple EMRs, e-prescribing systems, and contract pharmacy networks.

- The platform’s dashboards showed real-time expansion opportunities and contract pharmacy performance, and provided an overall compliance view.

Results Achieved

- $10M enhanced annual 340B contract pharmacy benefit.

- 100% reduction in high-risk 340B contract pharmacy claims.

- Two months of additional contract pharmacy claims eligibility.

Want Results Like Southwestern Academic Medical Center?

Our end-to-end 340B program management services can help you maximize 340B savings, ensure compliance, and reduce high-risk claims.

This case study above clearly demonstrates that technology platforms are essential for 340B compliance; however, one-size-fits-all solutions often fall short. The covered entities should prioritize platforms with customization capabilities that align with their specific site structures, pharmacy networks, and EMR environments. Additionally, some core features can directly address and help prevent the three most common HRSA findings, which are OPAIS record errors, duplicate discounts, and drug diversion.

Core Platform Features That Address HRSA’s Top Audit Findings

We have listed down some features after consulting our 340B experts with over 20 years of experience that you can integrate into your software or build your software around them to address the primary compliance, financial, and operational vulnerabilities identified in HRSA audits.

- Automated eligibility verification: Helps automatically verify whether a patient qualifies for 340B pricing by checking their status, location, and relationship with a covered entity, reducing human errors in eligibility determination.

- Integrated pharmacy systems: Connects electronic health records (EHR) with pharmacy management systems and billing platforms to ensure that 340B drugs are only dispensed to eligible patients.

- Real-Time monitoring: Tracks drug dispensing in real time, identifying potential instances of diversion in advance. Additionally, providing reminders, alerts, and reports that help staff take immediate collective action.

- Audited-Ready reporting: Generates detailed logs, making it easier to demonstrate compliance during HRSA audits.

- Contract pharmacy oversight: Optimizes 340B program management by integrating data from third-party pharmacies, verifying prescription and patient eligibility to prevent non-compliant dispensing.

- Diversion monitoring: Tracks 340 drug dispensing across all sites and contract pharmacies to ensure drugs are only given to eligible patients.

- Contract pharmacy management: Helps maintain proper documentation and adherence to program rules with contract pharmacy data feeds and split-billing.

- Medicaid claim monitoring: Automatically identifies and sends alerts when a 340B drug is dispensed to a Medicaid patient, preventing a duplicate discount being applied on the same drug.

- Compliance risk dashboard: Tracks 340B operations in real time, highlighting potential liabilities, risks, and areas requiring attention.

- 340B drug tracking: Help monitor drug purchases and dispensing across all sites and contract pharmacies to ensure accountability for every 340B drug and minimize errors.

- Repayment risk alerts: Monitors 340B program activity in real time and identifies non-compliance, helping staff take corrective measures before repayment occurs.

- Financial and compliance risk monitoring: Tracks costs, split billing, and drug inventory to minimize revenue leakage, helps prevent billing errors, and conducts continuous analysis of 340B transactions.

- Patient tracking module: Continuously monitors patient eligibility to ensure complete capture of all qualifying encounters.

- Integrated Pharmacy Billing Systems: Connects EHRs, pharmacy management, and billing platforms to eliminate human errors or duplicate efforts.

Additionally, we have prepared a quick 340B program risk assessment framework to help you pinpoint areas that need attention before issues escalate.

The above framework can help identify blind spots that often go unnoticed in day-to-day 340B management. By assessing each item, the covered entities can review the maturity of their current processes.

Want a More Detailed 340B Program Review?

Take your assessment further with expert guidance to spot potential vulnerabilities and ensure full HRSA audit readiness.

Ensure HRSA Audit Readiness and Optimize 340B Savings

Participation in the 340B Program offers numerous benefits, but it comes with increased responsibility. With growing enrollment, the likelihood of HRSA audits or even scrutiny via Medicare Cost Reports and Trial Balances is no longer a question of if, but when.

Organizations need intelligent solutions that not only maintain accurate documentation but also identify potential compliance risks. Here, strategic partnerships with third-party vendors can help with end-to-end 340B program management. In fact, 61% of healthcare organizations, according to a McKinsey study, will work with healthcare software development companies to address their talent shortages and meet evolving demands.

Book a 30-minute free consultation with our 340B experts, with over 2 decades of experience, to assess your program and identify risks.

Frequently Asked Questions

What is 340B?

The 340B Drug Pricing Program is a bipartisan federal program created to safeguard healthcare providers and patients from high drug costs. It requires the drug manufacturers to offer outpatient drugs at discounted prices to eligible healthcare organizations called covered entities.

How to ensure 340B program compliance?

Any entity that ensures 340B program compliance needs to have robust, detailed written policies and procedures. This requires a combination of accurate record-keeping, automated workflows, and expert oversight. Furthermore, it is crucial to maintain thorough documentation of patient eligibility, drug purchases, and dispensing, and to keep the Medicaid Exclusion Files up to date to prevent duplicate discounts. Plus, to avoid drug diversion, install a system that verifies patient eligibility at every counter, including contract pharmacies.

For HRSA inspection, regular internal audits, maintaining audit-ready documentation, and tracking compliance metrics are mandatory.

What is 340B replenishment?

It is a common method for effective inventory management in the 340B Drug Pricing Program, in which a covered entity purchases drugs at a reduced price (25-50%) after they are dispensed to eligible patients. There are two models in 340B replenishment given below:

- Physical Replenishment Model: Requires separate inventories for 340B and non-340B drugs, which simplifies tracking but increases storage needs and operational complexity.

- Virtual Replenishment Model: Dispenses from a regular inventory, while a third-party system can track eligible patients and order replenishments at 340B prices. Whilst specialized software can be used to automatically track order replenishment at 340B prices, eliminating separate stock and increasing operational efficiency.

Why is the 340B program becoming increasingly challenging to manage?

The program’s complexity has increased due to new manufacturer restrictions, evolving ESP/Beacon requirements, intensified audit scrutiny, and the need for TPAs and CEs to process and verify a massive amount of data, resulting in manual processes becoming slow, risky, and costly.

How do I know if my organization needs 340B optimization?

If your team is dealing with manual bottlenecks, frequent errors, slow submissions, compliance stress, or difficulty keeping up with multiple manufacturer requirements, then these are strong signs that you need 340B optimization. However, a short assessment can help pinpoint the areas that need the most attention, and our 340B experts can help you here. Book a 30-minute free consultation.

[tta_listen_btn]

[tta_listen_btn]

December 8 2025

December 8 2025